There are some big companies out there that you’ve probably never heard of, that know more about you than you can imagine.

They’re called data brokers, and they collect all sorts of information — names, addresses, income, where you go on the Internet and who you connect with online. That information is then sold to other companies. There are few regulations governing these brokers.

Data brokers have been around for a long time, collecting information about your magazine and newspaper subscriptions. They know whether you prefer dogs or cats. From public records they can tell if you drive a Ford or a Subaru or if you’ve declared bankruptcy.

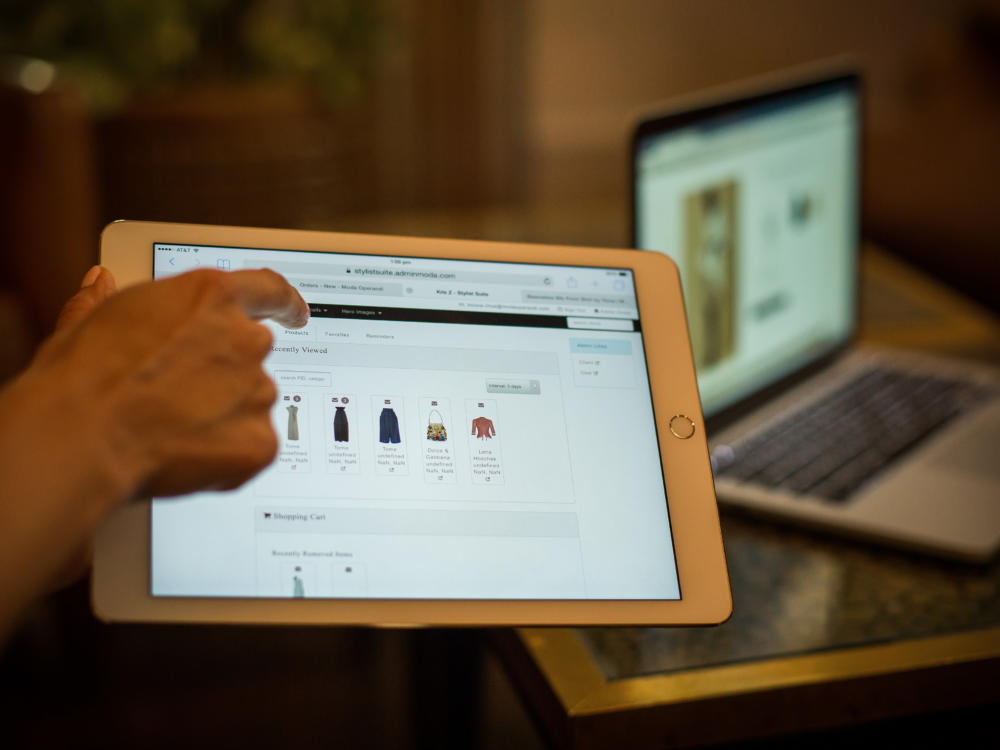

But the Internet upped the ante considerably. Think of all that personal data you share on Facebook, or your online shopping. According to Julie Brill, who recently stepped down as a commissioner on the Federal Trade Commission, these companies share just about everything.

“It’s what Web pages we visit, where we’re shopping, who we’re interfacing with on social media — all of that information is available to be collected by entities that park themselves on the various websites,” Brill said.

Once these companies collect the information, the data brokers package and sell it — sometimes to other brokers, sometimes to businesses — that then use the information to target ads to consumers. And it’s a lucrative industry. One of the largest brokers, Acxiom, reported over $800 million in revenue last year.

When the FTC studied data brokers two years ago, it found that brokers take the information they gleaned about consumers and use it to put us into categories.

Some of the categories are innocuous — pet owner, or winter sports enthusiast.

But Brill says others were more problematic, like “single mom struggling in an urban setting” or “people who did not speak English and felt more comfortable speaking in Spanish” or “gamblers.”

“And so the concern is not only the fact that these profiles are being created, but how are they being used,” Brill said.

Say, for instance, you do an online search for heart disease or diabetes.

Depending upon the website, that information can go to ad networks and analytics companies. If the contents of that heart disease or diabetes search end up with a data broker, that information could then be added to your digital biography.

“That becomes a part of your profile and others see that and can market to you based on that information,” Brill said.

And there’s little to stop data brokers from using the information they’ve gathered from us in whatever way they please, says Jeff Chester, a privacy advocate and director of the Center for Digital Democracy.

“Because there are no online privacy laws in the United States, there’s no stop sign, there’s no go slow sign, there’s no crossing guard. The message is anything goes,” Chester said.

Like Chester, former FTC Commissioner Brill says legislation is needed to make the industry more transparent.

She says there should be a website where consumers could see what data has been collected about them and correct it or block it from being used. Some individual companies, like Acxiom, do this.

And the industry does have voluntary guidelines to limit how information is used.

Xenia Boone is the vice president for corporate and social responsibility at the Direct Marketing Association, which represents many data brokers. She says companies are not creating “dossiers” about consumers.

Boone says marketing companies and fundraiser organizations “are working with data companies in order to get the right information about potential prospects because they need to go out there, they need the data in order to reach someone.”

A marketing industry website, aboutads.info, lets consumers opt out of having some ads sent to their browsers. Consumers can also block individual ads by clicking on that little triangle in the upper right hand corner of many of them. You can also install an ad blocker and clear the cookies from your browser.

But blocking ads is one thing, keeping your information away from the data brokers is much harder to do.

9(MDA3MTA1NDEyMDEyOTkyNTU3NzQ2ZGYwZg004))