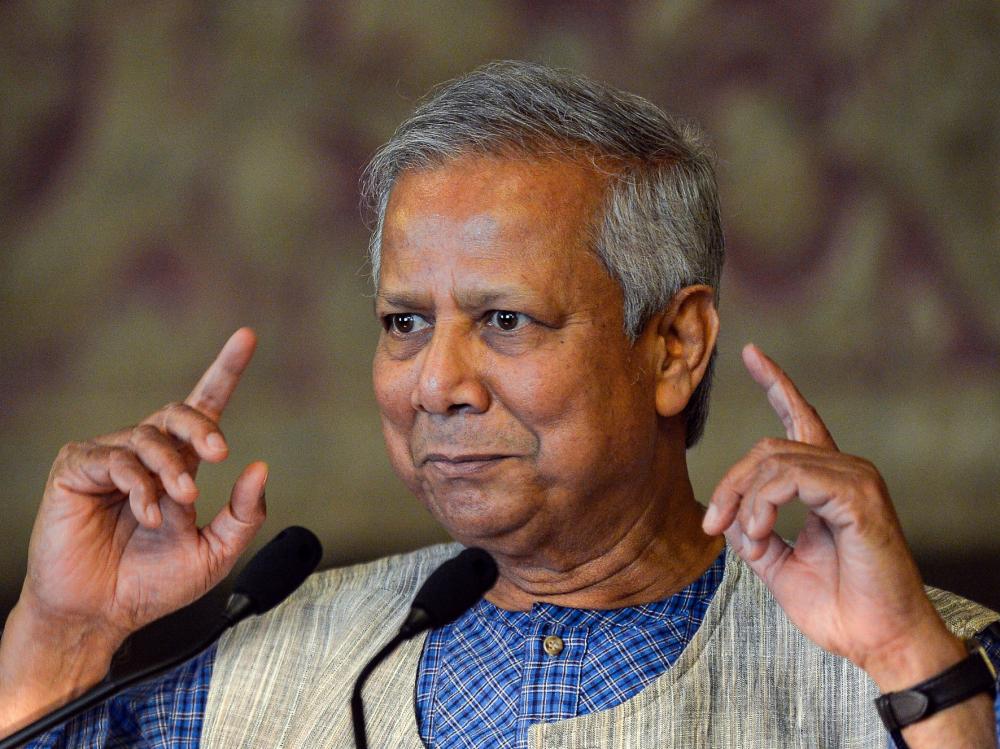

Muhammad Yunus, the founding father of “microcredit” and the 2006 Nobel Peace Prize Winner, is in New York City this week to take part in the annual Clinton Global Initiative meetings.

Yunus, a Bangladeshi and founder of the Grameen Bank, which makes loans to people too poor to offer collateral in return, is serving as one the judges for the Hult Prize, in which six teams of college and university students — the survivors of a rigorous worldwide winnowing — will present their ideas for sustainable businesses designed to help the poor.

This year’s theme is “Solving Non-Communicable Disease in the Urban Slum,” and the teams will present ideas that include distributing gum that prevents tooth decay (local students, at first in Bangalore, will sell the gum at a low cost), training slum-dwellers to manufacture and sell much-needed eyeglasses, and selling a low-tech, inexpensive medical pump that will aid in the treatment of open wounds.

The judges — CNN’s Dr. Sanjay Gupta is another — will also serve as mentors, guiding teams as they attempt to take their ideas to market. First prize is $1 million in seed money for the businesses, but given the deep-pocketed crowd the Clinton gathering attracts, it’s likely that teams besides the winner will find funders as well.

Yunus found a few minutes today between meetings to answer questions from Goats and Soda.

This is a very exciting project you’re involved in — the Hult Prize. Can you explain why entrepreneurship is an important model for interventions like these rather than something like direct public spending?

My position has always been that the world has been giving young people a very wrong kind of model, which is a job-oriented model. People have their education, and the first thing they do is they get out and they look for a job. I think that is a very limited ambition for human beings — to find a slot to fit into. A human being is a creative thing. In our DNA we are go-getters and problem-solvers. But instead we just put people into a small slot in a big machine.

I think the world should be an entrepreneurship-oriented world. So I endorse this entrepreneurship position that is taken by the Hult Prize.

Do you find that the Hult finalists — these are obviously smart people, often from top business schools, with excellent ideas …

My position is that all people are smart people. There are no special smart people from the top business schools.

But are there things that you find you have to teach them about the developing world — things that they aren’t grasping?

That’s my job. That is what I do, I communicate with them. Whether they pick it up, or some of them don’t pick it up, that’s okay.

How do you see these entrepreneurial projects as interacting with governmental programs? Some people worry that overemphasizing private initiatives threatens to overshadow potentially more consequential governmental efforts

What is a governmental project? I don’t get it.

Direct state-based aid, for example.

Government doesn’t encourage entrepreneurship. Government is job-oriented. They always talk about how many jobs they have created. They don’t say how many entrepreneurs they have created. They should. They should try to create entrepreneurs, rather than job-create.

Microcredit, in which banks lend extremely poor people small amounts of money, relying in part on peer pressure to encourage repayment, is both tremendously popular and, in some quarters, controversial. What is the statistic that you like to cite to show how effective it’s been? What’s the single thing you point to?

I think the thing about microcredit is that the banking system doesn’t work for people. It works for people who have lots of wealth. It’s a wealth-oriented banking system, not a people-oriented banking system. That’s why it depends on collateral and so on. So what microcredit did was it removed the collateral issue; it is trust-based banking. This is what the banking system should have been. It should have been an inclusive banking system rather than an exclusive banking system.

In Grameen Bank, which I created in Bangladesh, we have now eight and a half million borrowers. Most of them are women: 97 percent of them are women. The bank is owned by the borrowers. It’s not owned by some rich guy somewhere else. And the borrowers are on the board, making the decisions. Today, the Grameen Bank lends out one and a half billion dollars each year and each year that figure is increasing. We’re in a situation where the savings of the borrowers, kept in deposits in the bank, exceeded the total loan they make. We have created a new kind of relationship between the bank and the borrower.

There have been criticisms, for example, that people who have been struck by natural disaster find themselves unable to pay off their loans—they entered a debt spiral. Have you had to make course corrections to deal with that?

No, no, no, no. This is part of the bank’s job. It’s [the borrowers’] bank, and they are hard hit when the flood comes. And it’s flood season right now in Bangladesh.

So the bank has to change gears, in effect, when a disaster strikes?

They have a standard procedure, where when the flood comes in, then the bank becomes a humanitarian organization: to save them, to feed them, to take care of them, to give them medicine. And then when the flood is over, to get them back to their homes, rebuild their homes, rebuild the business.

You cannot run a bank for poor people in Bangladesh without considering the disaster situation, which is caused by the floods, the cyclones, and the tidal waves, which happen so frequently with the global warming. It is becoming more frequent; so it is a part of life.

There was a power struggle over the Grameen Bank with the Bangladeshi Prime Minister, Sheikh Hasina. I take it you were more or less forced out in 2011. But you sound quite proud of its continuing work.

Sure, it’s a good bank, it works well. I created it and it continues to work

So that government takeover didn’t hurt the bank

They are trying to take it over but they still have not been successful.

I’ve read that microcredit is taking off in the United States.

There are seven branches of Grameen America in New York City. We have nearly 25,000 borrowers in New York City — 100 percent of them are women. In New York City the average loan is 1,500 dollars; and the repayment date is nearly 100 percent it’s 99.4. They follow the same procedures and rules in as Bangladesh.

We also have two branches in Los Angeles; two branches in San Francisco and ones in Houston; in Boston; in Charlotte, North Carolina; Omaha and Indianapolis. Many more cities are in the pipeline.

Is that a sign of how flexible microcredit is, or a sign that the United States has become a more unequal place that does not serve its poor particularly well?

It is a sign of how robust microcredit is, how well-designed microcredit is. It can work in any situation anywhere in the world. It’s for people that [traditional] banks will not come anywhere near. People are left to loan sharks. They are left to payday lenders with the interest of 1,000 percent and 2,000 percent because a bank will not come and do business them.

The whole banking system is unequal. It’s not just the United States. It’s a global phenomenon.

The microcredit system is partly based on peer pressure; do we have the same norms here in the U.S, the same social cohesion, to make microcredit work?

We have been working right here in New York City for the last six years and there are seven branches. So it works. Before Grameen, people said, “It can’t be done.”

This interview has been edited and condensed for clarity.

9(MDA3MTA1NDEyMDEyOTkyNTU3NzQ2ZGYwZg004))